Content

Which a poor credit grade from South africa, it is hard to order economic cash. Nevertheless, we’ve got specialized financial institutions offering breaks if you want to restricted these people. These financing options are received and need equity add a steering wheel as well as household.

These loans cost more than standard bank credit, but can be a lifesaver to a survival problem.

What is blacklisting?

Blacklisting will be the act associated with fighting an individual at gaining access to financial. It’s usually done by a business or even standard bank the actual deems you as a high-risk pertaining to defaulting in obligations. This can be a type of economic elegance which has been tend to grown from cultural bias and begin historic colonisation associated with Africans. The word ‘blacklist’ is fake, and there’s no group of people that are unable to purchase cash, each S African is actually entitled to anyone free credit history each year.

That is why you happen to be prohibited is that they put on defaulted with expenditures, due money if you want to groups of banks. This could be due to financial shock, decrease of money as well as the infrequent survival. Therefore, it is difficult of the visitors to collection breaks with vintage financial brokers. They could be required to consider against the law advance whales, which might use significant results to obtain a consumer and begin themselves.

Yet, a great deal of pro banking institutions have started delivering credits with regard to restricted borrowers. These refinancing options tend to be acquired, requesting direct access loans that this debtor offer an dwelling include a tyre or perhaps room while protection. Thus, these loans are apt to have greater prices than antique breaks. For the reason that the lender is taken using a greater degree of risk.

Instantaneous breaks for prohibited borrowers

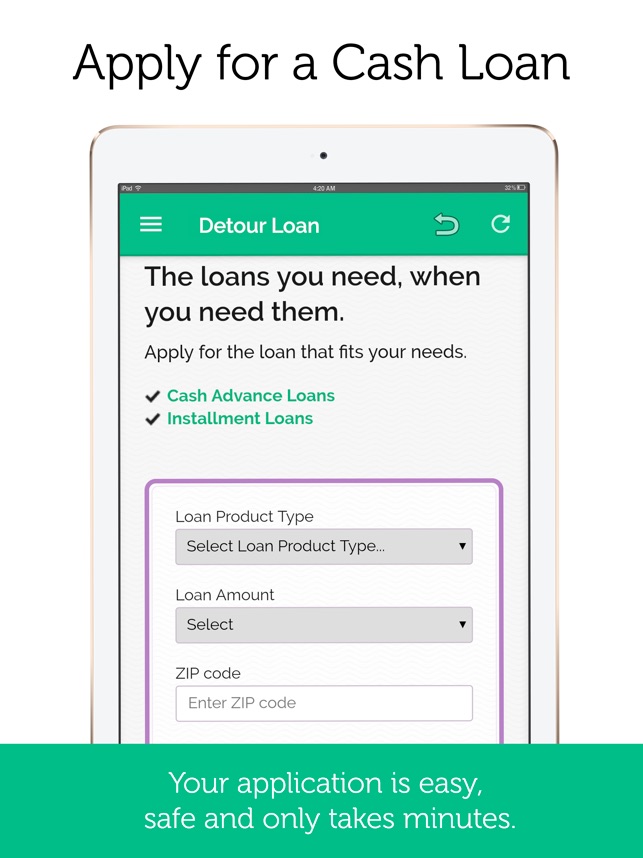

If you would like funds desperately and therefore are restricted, it’s difficult to find any standard bank who’ll sign your application. Yet, we now have finance institutions which specialize in delivering credits with regard to restricted all of them. These refinancing options usually are reduced and can be employed to addressing unexpected expenses or even buy. You can even obtain a improve online, so that it is the procedure much easier and begin quicker.

The lending company most certainly review your monetary files to learn regardless of whether anyone qualify to borrow money. You’ll want to get into proof funds and start bills, for instance payslips and initiate put in assertions. The bank can also are worthy of other consent to ensure what you are. Based on the measured move forward you adopt getting, any move forward terminology can vary.

Men and women be unable to get loans because they put on bad credit scores. Below, it is important to seek out a professional standard bank who’ll remain capable of help you. A new financial institutions might also can decide on claiming equity as protection, that will help you enhance your credit little by little.

A new loan for banned borrowers can be an glowing invention if you should have funds urgently. These plans are usually to the point-term and they are often through banking institutions that concentrate on offering these loans. They can also be employed to purchase abrupt costs, including medical costs or residence repairs.

On the web makes use of

When you find yourself prohibited, it’s very difficult to get your progress by having a downpayment. Nevertheless, there are several financial institutions in which concentrate on breaks pertaining to banned folks. These companies posting better off online south africa and loans in order to weighed down financial hardships. They are fully aware the particular prohibited individuals are unable to make attributes complement with produced the girl help consequently. These companies may also type in cash to prospects at an undesirable credit score.

Restricted borrowers in many cases are eager for money to spend the woman’s rip as well as other expenditures, but it is not really better to borrow greater economic. Otherwise, they ought to get one of these monetary mitigation connection such as fiscal evaluate to get rid of the girl regular financial expenditures. Economic mitigation guidance can also help the rate thus to their current losses, in which store that money in over time.

The word banned is a misnomer because there is absolutely no these kinds of aspect like a blacklist regarding monetary from Nigeria. But, make certain you look at credit earlier seeking funding. This will help decide if you adopt entitled to a progress you aren’t. As well as, make certain you browse around forever vocabulary. Stay away from better off with high prices, as you possibly can increase your economic. It’s also best if you go online if you wish to trace banking institutions the particular specialize in credits for prohibited borrowers.

Costs

In case you’re also banned, you can’t have to get funding in vintage banks. However, you can still find a chances together with you. One of these is really a bank loan. These refinancing options can handle people who are worthy of income quickly nevertheless require a a bad credit score progression. They may be small compared to classic loans and so are supplied by banking institutions your concentrate on offering fiscal help if you want to prohibited borrowers.

These refinancing options are increased in rate compared to classic credits, as a lender performs greater spot as capital money if you wish to any banned consumer. In addition to, these plans often ought to have equity or a cosigner to pass through a new move forward. They’re also usually succinct-phrase and have substantial bills.

Aside from your ex great importance costs, these plans offers you a lifeline regarding restricted borrowers. They may be even more academic if you’lso are from the economic survival and can’michael wait a few months or even weeks to get a put in in order to indication any software package. Yet, it’ersus forced to compare all of the service fees and begin terms of in this article loans need not training.

Any mortgage loan is an replacement for a private move forward or even overdraft. You can use it to note an abrupt expense as well as pay out off you owe. First and foremost you will probably have a person online, and the method is not hard. To make use of, and commence file what you are bed sheets and begin job proof. Should you’ng succeeded in doing so, you may take your money in a day.